10 Questions to Ask About Earnings Improvement Programs

Why Some Succeed and Others Do Not

Mark Crockett and Adam Wayment

Every year, ~15% of public companies announce earnings programs.

~70% fall short

While most earnings efforts fall short, some companies grow operating margins year after year, even in bad markets. What makes the difference between those who succeed and fail? What are the successful companies doing differently?

Traditional consulting firms that rely on smart young people to provide high-level, outside-in and top-down recommendations don’t often get the job done. Those firms and many of their clients acknowledge that over 40% of the committed savings fail to materialize.

Over many years working with and investing in management teams to grow earnings, we observe that leaders of successful earnings programs follow 10 Key Principles:

1. LINE MANAGERS MUST OWN THE CHANGE. Consultant recommendations and management mandates are one thing. Actual change is another. The key to sustainable change is front-line buy in. Line managers need to champion the change down in the details. Stakeholders need to sign off in advance. Only then can one be sure of the results. To get bigger results and nearly 100%-certain implementation, a completely different approach is required – generating buy-in and accountability from day 1.

How it Builds Buy-In

When front-line managers and their teams develop and champion specific and detailed changes themselves, they are ready to be held accountable.

Questions to Ask:

“Who is recommending the decisions for change? How do you know the change will be made and sustainable?”

• Typical Answer: “We hired XYZ consultants and they said we should be able to get ____. Each of our leaders now has a target and an incentive program to go get their targets.”

• Better Answer: “Our line managers are leading the change. They have worked through the detail and know exactly what changes they are making. Key stakeholders are bought in.

2. FOLLOW THE MONEY. When asked why he robbed banks, Willie Sutton famously said, “That’s where the money is.” Going after low-hanging fruit is fine, but the real money is made by systematically scrubbing through each bucket of revenue, cost and capital expenditures to find earnings increases across the board. Good leaders know where they spend money. They find improvements on every line item. Each purchase, process and function is an opportunity.

How it Builds Buy-In

By engaging front-line leaders, existing frustrations are surfaced and interlocking pieces are solved together.

Questions to Ask: “How are you developing your opportunities to improve earnings? How are you prioritizing and driving those opportunities?”

• Typical Answer: “We have plans to consolidate ____ and streamline ____.”

• Better Answer: “You can see where we spend our money. Our line managers are finding improvements on every line item. Each purchase, process and function is an opportunity. We are scrubbing through all our accounts, products and channels to maximize our profits and growth opportunities. The highest priorities are with the biggest dollars.”

3. DON’T JUST CUT COSTS. CHANGE THE WORK. It is painful, but relatively easy to fire people. Then what? Unless there is less work to be done, things start to break. Customers get irritated and cut orders. It becomes a vicious cycle. Successful companies redeploy staff only when they know how the work will change, ensuring that gains are sustainable

How it Builds Buy-In

Most employees have read Dilbert and fear stories of cuts, broken processes, angry customers and longer work hours. But redesigning and simplifying the work is energizing. They feel heard and see a more productive future. They get excited.

Questions to Ask: “How are you changing the work to make these improvements permanent? If revenue goes up by 10%, how much cost will you have to add back?”

• Typical Answer: “We are determined to match our costs to revenue and are making the cuts to do so. We will do more if necessary.”

• Better Answer: “We have found many ways to rethink and redesign our work. Let me give you some examples… Whether revenue grows or doesn’t, we can permanently grow margins.”

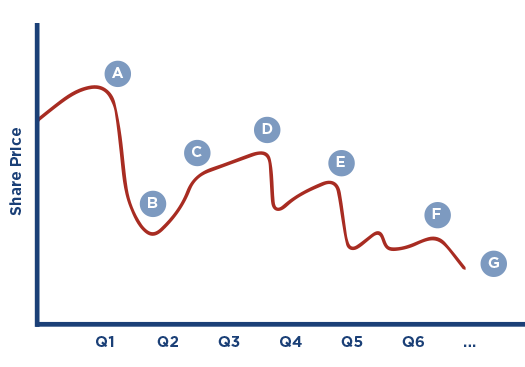

EXHIBIT: A FRUSTRATINGLY FAMILIAR PATTERN

From years of reading countless earnings calls trying to sift the golden investments from those going nowhere, we see a familiar pattern: 1

A. After a period of success, things begin to change. Investors are surprised when management lowers its earnings outlook.

B. Eager to restore confidence, management announces an earnings initiative.

C. Investors are relieved.

D. A couple of quarters later, investors ask about the initiatives. “We are making real progress. It may take a bit longer, but we see lots of opportunity.” 2

E. Investors ask again if earnings are on target. “Yes. We have implemented $18 million and expect $38 million.” The follow up question: “Are those numbers on top of or included in the $50 million you announced before?” Then management begins to stammer, “Well some of the 18 is in the 50 and some of the 38 is new and some …”

F. A few quarters later, management concedes that after a determined effort, results have not improved. In many cases, performance metrics decline.

G. The share price falls off and there is often a change in leadership.

4. ADD NEW PERSPECTIVES TO WHAT YOUR EMPLOYEES ALREADY KNOW. We often hear employees say, “This is a waste of time, but ____ says I have to do it this way.” What they are saying is they have a real problem and need help to fix it. Many of the biggest opportunities tend to be interrelated and cross multiple departments. Outside perspectives can help. Successful companies pair expert problem solvers with front-line leaders to capture these opportunities.

How it Builds Buy-In

The front-line sees what isn’t working – they want things fixed. With a process to collaborate, solve and make decisions, people like to see progress.

Questions to Ask: “Who is developing your ideas for change? Who is challenging existing ways of doing things?”

• Typical Answer: “We have a pretty good idea about how to tighten the bolts.” Or, “We hired some outside experts and they are coming up with some great ideas.”

• Better Answer: “Every manager is working with their teams to develop specific and actionable earnings increases. Peers from across the company and experienced earnings experts challenge our assumptions and leave no important stone unturned.”

5. KNOW YOUR PROFIT DRIVERS. Many companies focus too narrowly on gross margins. Higher gross margins are better than low ones, but the point is bottom-line profits.

Example: A semiconductor equipment maker boasted its 55-65% gross margins. But those margins were consistently eaten up in R&D and marketing costs. Over the semiconductor cycles, they never managed to earn a positive return to capital.

The key is to (roughly) understand the net profitability of products, transactions, customers, channels, etc. – and to consciously drive the bottom line of each. Intensive profitability models can be complicated and unwieldy. But if each transaction, vendor, customer, channel and product is more profitable, then the company will be more profitable as well.

How it Builds Buy-In

People want to feel they are successful and making a difference – for customers and their company. Growing profits feels good

Questions to Ask: “How do you use metrics to drive profitability improvement across products, customers and channels? How is sales involved in driving profitability metrics?”

• Typical Answer: “We are proud of the progress we are making to increase gross margins and the contribution margins of our products.”

• Better Answer: “We are all about bottom line profits and risk-adjusted returns to capital.

We focus on increasing the economic value of each of our activities, customers, products and services. Our sales team is learning to match the value and pricing of our services and we are matching our sales incentives more closely with profitability.”

6. QUANTIFY THE IMPACT. Successful companies systematically use facts and analyses to get past traditional thinking and gut feelings. Each change needs its own mini-P&L (with one-time costs, personnel changes, impact on revenue, etc.). Only then can those benefits be objectively weighed against potential risks.

How it Builds Buy-In

Giving front-line leaders a simple and structured way to build business cases enables them to lead out and provides executives the information needed to make decisions more quickly – generating momentum in the organization.

Questions to Ask: “At what level of detail are you making decisions? How are you balancing risks and rewards? What fields are included in your business case template?”

• Typical Answer: “We are working through several initiatives and the leader of each will be given a new target.”

• Better Answer: “Each of our broad initiatives is broken into specific changes. Each change has its own mini-P&L and ROI and is reviewed consistently against other possibilities. Everyone who could be affected by the change weighs in about the risks and rewards before we decide.”

7. KEEP SCORE. Budgets can be like balloons. You push on one side and they expand on the other. Companies that don’t keep score won’t win and won’t realize it until it is too late. To avoid surprises and sustainably capture savings, successful companies track and hold leaders accountable for three separate measures:

• the work has changed

• positions go away with the work

• per unit metrics improve as planned

Only then can one be sure earnings will increase – even as volume changes. Tracking things can be complicated without a tested approach. Companies that are serious about driving earnings use a score-keeping system from start through completion. 3

How it Builds Buy-In

“How will you see when these changes take effect? What tracking systems do you have in place? What happens to these numbers if revenue goes up or down?”

Questions to Ask: “At what level of detail are you making decisions? How are you balancing risks and rewards? What fields are included in your business case template?”

• Typical Answer: “The leader of each initiative has a number to get.”

• Better Answer: “We are tracking every approved change with milestones, metrics and financial outcomes. Of course, we also have a good incentive plan to reward successful leaders.”

8. SET A SHORT TIMELINE AND USE A PROVEN PROCESS. Earnings programs need to accelerate in an orderly way to conclusion. People need clear marching orders – with new tasks and skills almost every other week. About 100 days to do the analysis, get consensus and make decisions is the right timeline for optimal results. 4

How it Builds Buy-In

Earnings programs need a start and an end to celebrate. If the program is too short, people can’t get enough done to move forward in confidence. If things drag on too long, momentum bogs down and people wander off.

Questions to Ask: “What process, training guides and tools are you using to identify, quantify and drive earnings improvements? Who is leading the effort? When does it start and when does it finish?”

• Typical Answer: “We are using our standard project planning process.”

• Better Answer: “We aren’t taking any chances and are determined to get the best results with the least interruption possible. So we are adopting a proven process with weekly tasks and milestones and software tools to keep things simple and on track. We will have a good idea of what we are going to achieve by [Date].”

9. USE PURPOSE-BUILT SOFTWARE. Earnings programs involve a lot of information: baseline data, business cases for each change, documentation of buy in and decisions, tracking of milestones and metrics, incremental cash flows and P&Ls for re-budgeting… Everything needs to be in a consistent format so senior leaders can easily evaluate alternative ideas. Everything needs to be online so people can weigh in and track progress. Excel won’t do. PowerPoint should not be allowed.

How it Builds Buy-In

With the right tools, front-line leaders and their teams can build their own business cases – they own the details.

Questions to Ask: “What tools are you using to manage all the changes, document buy in and track through implementation?”

• Typical Answer: “We have developed some good templates for people to use. Our PMO function will follow up to make sure everything is completed.”

• Better Answer: “We use a web-based system that steps our people through business cases, stakeholder buy in and decision making. It helps track milestones and metrics and generates incremental cash flow statements and budgets. All reports are automated. I can see how every change is tracking from my iPad.”

10. GET EXPERT COACHING. Earnings programs are not easy. Expert coaches can make them easier and significantly reduce execution risk.

How it Builds Buy-In

With the right tools and coaching, front-line leaders build capabilities to develop and champion their own recommendations for change – the way senior management would, if they had the time.

Questions to Ask: “Who is helping you with your earnings program?

What is their philosophy about change? What team do they bring?”

• Typical Answer: “We hired one of the big firms. We like the partner. They have a group of smart young people to get work done.”

• Better Answer: “We are partnering with a firm that specializes in buy-in driven earnings programs. Their team brings deep operating and earnings experience, but they are helping our own people develop and drive the changes.”

These are not the only principles for an ideal earnings improvement program, but managers who follow

these principles will build better companies and earn higher share values with significantly

lower implementation risk.

Research Approach

Our primary research objective was to identify the differences between successful and failed earnings improvement initiatives. Our findings come from an exploratory study of management practices in more than 150 companies that have publicly announced expected improvements to earnings from cost reduction and other performance improvement initiatives. We conducted interviews of 45-60 minutes each, discussing the internal methodology each company used and specifically asking whether the key principles in our hypothesis were followed. We adjusted our hypothesis as the interviews proceeded. The interviews were semi-structured to allow opportunities for the interviewees to volunteer

information and for the interviewers to pursue interesting and relevant lines of questioning. Interviewees were typically CFOs. Data collection extended beyond the interview to include press releases, financial statements, company conference calls and stock prices.

Findings

Companies that systematically followed the principles and practices above were far more likely to achieve their stated earning improvement and operating margin objectives. They were also more likely to redeploy increased earnings into productive growth initiatives. In nearly all cases where companies did not follow most of the practices above, results were disappointing.

About Vici Partners

ViciPartners specializes in growing earnings through execution – bringing a proven system to help companies tap into and build the capabilities of their own people. Vici aligns its incentives with results, typically generating over 300 basis points to operating margins. Mark Crockett and Adam Wayment are partners of Vici. Please feel free to contact them at [email protected] and [email protected]

References

1. Although stock price graphs are not applicable for private companies, we see the same pattern and a similar dialog between management and equity sponsors.

2. Quotes are simplified and representative illustrations of actual comments frequently made in company releases and in our interviews with management.

3. One of the biggest pitfalls is: “We are going to stop doing this and start doing that.” When managers suggest these two separate ideas as one, they are holding management hostage, saying, “We will only free up these resources if we get to decide how to spend them.” What if it makes sense to stop doing “this”, but there are higher priorities than “that”? It is everyone’s job to free resources. It is management’s job to deploy them. Only when companies separate their cost savings ideas from their revenue growth ideas can they be sure to capture the gains.

4. Ideal timelines may vary by country and situation.